It must have been your concern how you can build a crypto portfolio. Frankly, putting money into cryptocurrency can be really hectic and confusing.

But the best part of this is, getting the needed resources and guidance to kick start. When one invests in multiple cryptos, he or she can set an asset allocation that can reflect the total sum of risks he or she is comfortable with and his or her overall potential earnings that come out of this to help him or her reach financial goals.

Read Also: Bitcoin Price: How Much Does A Bitcoin Costs Today?

Crypto Portfolio

Anyone looking forward to invest and build the biggest crypto portfolio for themselves or someone must always remember that even as crypto usage has been notified by many, it can still be a volatile investment.

This reality should be top-of-mind as you build a well-structured portfolio. This is because, unlike other traditional investment portfolios, this type of portfolio has a single asset class that mostly) always come with a higher risk profile level.

Here, you are then advised to put varieties of crypto portfolios into consideration and choose which one you’d be ready to lay your risk on.

As of last year, cryptocurrencies have maintained their spot as being highly unregulated in the United States as well as many countries across the globe.

The more it changes in state, cryptocurrencies receive greater regulatory checks that could affect its value and different coins. When this happens, you might be needed to restructure your portfolio to fit in.

Crypto Investment Basics

Are you eager to invest in this? Make sure to be certain of having at least some knowledge on what you’re putting your hard-earned money into. Check these basics below;

Coins or tokens are stored in a wallet. It is accessible with both private and public keys that let users interact and interface with one another.

Cryptocurrency is also a digital currency used in financial transactions between entities, groups of individuals, companies or individuals who don’t require to go to the bank or any other third party to make direct payments/transactions.

Also depending on the type of cryptocurrency units are called the following names; coins and tokens, altcoins are the coins developed as an alternative to bitcoin.

All investors can buy tokens/coins or shares of them on online cryptocurrencies exchanged by joining a bank account and strolling through a verification process that’s also similar to opening an account to trade stocks or other securities.

Diversifying A Crypto Portfolio

Currently, there are thousands of cryptocurrencies available for grabs which are relatively estimated ranging from 6,000 coins to over 10,000 with a sum market capitalisation of nearly $2trillion.

Fortunately, few companies are leading the crypto world of online investment as measured by market cap, Ethereum, Cardano, Bitcoin, Litecoin and Dogecoin.

Therefore, you should know that, a crypto portfolio can have one or more of the above-mentioned cryptocurrencies additionally to some of the other medium and small cryptos available in small market caps.

Ethereum

Ethereum is one of the world’s leading cryptocurrencies with a market cap of over $200billion. Ethereum is also known to be a programmable blockchain that permits the building and decentralisation of applications and also the making of smart contracts.

Its currency is also known as Ether represented by ETH. It is the main mean of exchange on the Ethereum crypto platform. On Ethereum, there isn’t a limit to the number of times an ETHs can be created, unlike Bitcoin.

Cardano

Cardano is the sole property of Charles Hoskinson and Jeremy Wood. It was created in the year 2017. Charles Hoskinson co-founded Ethereum so it is not a surprise to find out that Cardano and Ethereum have a common sense of look or similarities.

Just like Ethereum, Cardano developers were able to use the Cardano blockchain to write smart contracts and decentralize applications(dApps).

Cardano hoards a large library of academic research that its founders point to as a factor that makes the blockchain special.

Its creators hoped that the platform will be used by visionaries and innovators to create a conducive and positive change in this world.

Bitcoin

As of the first visit of 2022, Bitcoin is by far the largest cryptocurrency with a market cap of about $1trillion. It was the first cryptocurrency to hit the market in the year 2009.

It remains the most popular cryptos as of today. Bitcoin introduce the use of blockchain technology, which is a decentralized public ledger that has a digital record of every Bitcoin transaction.

Additionally, Bitcoin pioneered the basic system of cryptography and peer-to-peer verification that is basically the foundation of most types of cryptocurrencies in today’s world.

However, as of September, 2021, there has been over 18.8million Bitcoin tokens in calculation against a capped limit of 21million.

Dogecoin

Dogecoin was officially launched into the crypto system in 2013 as a way to poke fun at Bitcoin. The Dogecoin currency has since its introduction, earned people’s attention and involvement and has received a wholesome amount of investment over the years. It currently has a market cap of over $33billion.

Dogecoin has similarities with the famous Bitcoin and Ethereum. They all run on a blockchain network but the only thing is the number of coins that can be mined is just unlimited.

Litecoin

Since Litecoin was introduced into the world of cryptocurrency, it hasn’t won much attention as compared to other forms of cryptocurrencies like Ethereum, Bitcoin and Dogecoin.

It was created in 2011 and has made lots of improvements. On the side of pricing, Litecoin’s price is totally correlated to Bitcoin’s; rising when Bitcoin rallies and falling when Bitcoin declines.

Litecoin also has a speedy transaction rate and lower fees. There are many merchants, vendors and blockchain applications that have introduced Litecoin payment as a payment method. However, Litecoin has a market cap of about $12billion.

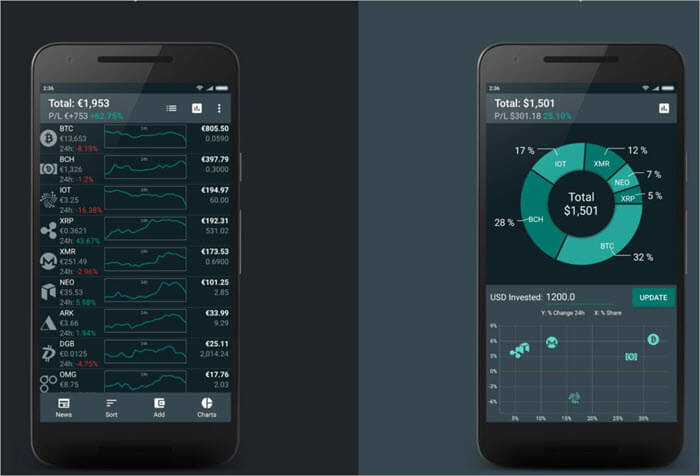

How To Build Crypto Portfolio

Making research and building a crypto portfolio could be time-consuming most especially if you want to place together with the best crypto portfolio for personal goals and the ability to take risks.

How To Get Started

Know Most Recent Crypto Values

CoinMarkets and Live Coin Watch are presently the best places you can start to see what kind of update is on the world of cryptocurrencies. Here, you can get access to the values and rates for which they’re being traded for.

Make Research

On most crypto platforms, white papers are being published for updates, news and other research reports just like Bitcoin white paper was published in 2018.

It jump-started the crypto revolution. These informative reports mostly explain how crypto works, its roadmap and what it is designed to do.

Know How To Use The Currency

Knowing how to use the currency can be the biggest advantage you’ll ever learn. Now, you can go forward to ask; what gives a specific cryptocurrency value.

A currency that has no solid value to the public or investors may not really be valuable in the market.

Also, currencies that are predicated on innovation or developing fresh systems or technologies has the ability to make it through the system.

Follow Cryptocurrency News & Events

Nothing is static in cryptocurrency. Everything can change pretty fast and quick even with developed cryptos like Dogecoin, Ethereum and Bitcoin.

The news can also affect rates and trade forms which you don’t have to miss it. Being up-to-date with events and news can help investors make delightful decisions about how and when to trade.

Consider Stop Loses

The crypto market can be volatile so it is a good idea to set some regulations and guardrails around your investments such as stop loses. Stop loses are orders to sell an asset when it falls to a befitting price.

Also, setting stop loses on cryptos can help to protect Investors from taking too big of a hit to their cryptocurrency portfolio’s value in case the prices drop.