The current Bitcoin market is a dynamic and complex environment that offers both opportunities and risks for investors and traders.

Bitcoin is the most popular and widely used cryptocurrency in the world, with a market capitalization of over $500 billion as of August 26th, 2023.

However, it is also one of the most volatile and unpredictable assets, with frequent price fluctuations and swings.

Read Also: Bitcoin Price: How Much Does A Bitcoin Costs Today?

Factors That Affect The Bitcoin Market

Supply And Demand: The supply of Bitcoin is limited to 21 million coins, which are released gradually through a process called mining.

The demand for Bitcoin depends on various factors, such as user adoption, innovation, regulation, media attention, and market sentiment.

When the demand exceeds the supply, the price tends to rise. When the supply exceeds the demand, the price tends to fall.

Halving Events: Every four years, the reward for mining new blocks of Bitcoin is cut in half, reducing the rate of new coin creation.

This creates a scarcity effect that can boost the price of Bitcoin as the supply becomes more limited.

The most recent halving event occurred in May 2020, when the reward dropped from 12.5 to 6.25 BTC per block.

Innovation And Adoption: Bitcoin is constantly evolving and improving through the efforts of its developers and community.

New features and upgrades can enhance the security, scalability, and usability of Bitcoin, making it more attractive and valuable to users.

Additionally, as more businesses, institutions, and governments accept and support Bitcoin as a legitimate form of payment and asset, the price can benefit from increased legitimacy and demand.

Challenges And Opportunities: Bitcoin also faces many challenges and opportunities in its journey to become a global currency.

Some of the challenges include regulatory uncertainty, hacking attacks, technical glitches, competition from other cryptocurrencies, and environmental concerns.

Some of the opportunities include increased awareness, education, innovation, integration, and adoption.

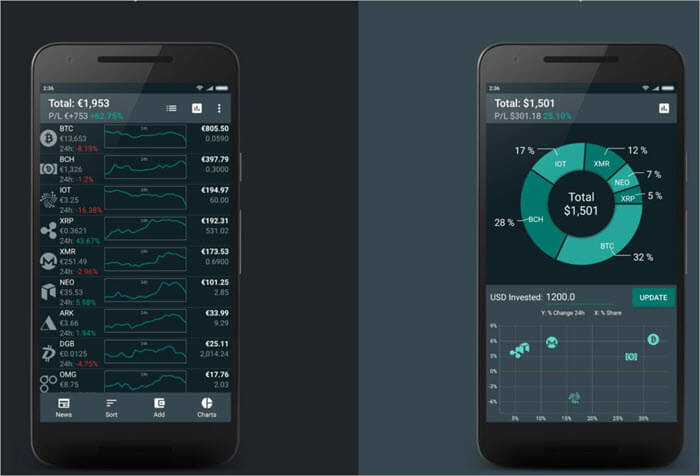

To participate in the Bitcoin market, users need a Bitcoin wallet, which is a software or hardware device that allows them to store and manage their crypto assets.

There are many types of Bitcoin wallets available, each with its own advantages and disadvantages. Some of the factors to consider when choosing a Bitcoin wallet are:

Security: The security of a Bitcoin wallet depends on how well it protects the user’s private keys, which are used to access and control their funds.

Some wallets use encryption, password protection, backup options, recovery phrases, or biometric authentication to enhance security.

Some wallets also offer cold storage, which means storing the private keys offline or on a separate device that is not connected to the internet.

Cost: The cost of a Bitcoin wallet depends on whether it is free or paid, and whether it charges any fees for transactions or services.

Some wallets are free to download and use, while others require a one-time purchase or a subscription fee.

Some wallets also charge fees for sending or receiving payments, converting currencies, or accessing third-party platforms.

User Experience: The user experience of a Bitcoin wallet depends on how easy it is to use and navigate, how fast it is to perform transactions or sync with the network, how compatible it is with different devices or platforms, how customizable it is with different settings or features, and how attractive it is with its design or interface.

Supported Cryptocurrencies: The supported cryptocurrencies of a Bitcoin wallet depend on whether it can store and manage only Bitcoin or other coins as well.

Some wallets are dedicated to Bitcoin only, while others are multi-currency wallets that can support hundreds or thousands of different coins.

Some wallets also allow users to exchange or swap coins within the wallet itself or through third-party platforms.

Customer Satisfaction: The customer satisfaction of a Bitcoin wallet depends on how well it meets the expectations and needs of its users, how reliable and trustworthy it is, how responsive and helpful its customer support is, how frequently and effectively it updates its software or firmware, and how positive or negative its reviews or ratings are.

Read Also: Bitcoin Since Its Inception In The World Of Trade

Best Bitcoin Wallets 2023

Ledger Nano X

A premium hardware wallet that offers high security, versatility, and integration. It supports over 1,800 cryptocurrencies, has a Bluetooth connection for mobile devices, has a web-based user interface with built-in exchanges, and costs $119.

Trezor Model T

A high-end hardware wallet that offers strong security features and an open-source software. It supports 14 native cryptocurrencies and hundreds more through third-party integrations, has a touchscreen for easier input, has a web-based user interface with built-in exchanges, and costs $219.

Exodus

A user-friendly desktop and mobile wallet that offers a sleek design and a simple interface. It supports over 100 cryptocurrencies, has an integrated exchange platform, has live charts and portfolio tracking tools, and is free to use.

Electrum

A powerful and advanced desktop wallet that offers a high level of control and customization. It supports only Bitcoin, has a variety of features such as multisig, cold storage, and replace-by-fee, has a fast and lightweight performance, and is free to use.

Mycelium

A popular and reliable mobile wallet that offers a high degree of privacy and security. It supports only Bitcoin, has features such as HD, Tor, and hardware wallet integration, has a fast and easy-to-use interface, and is free to use.